child tax credit 2021 eligibility

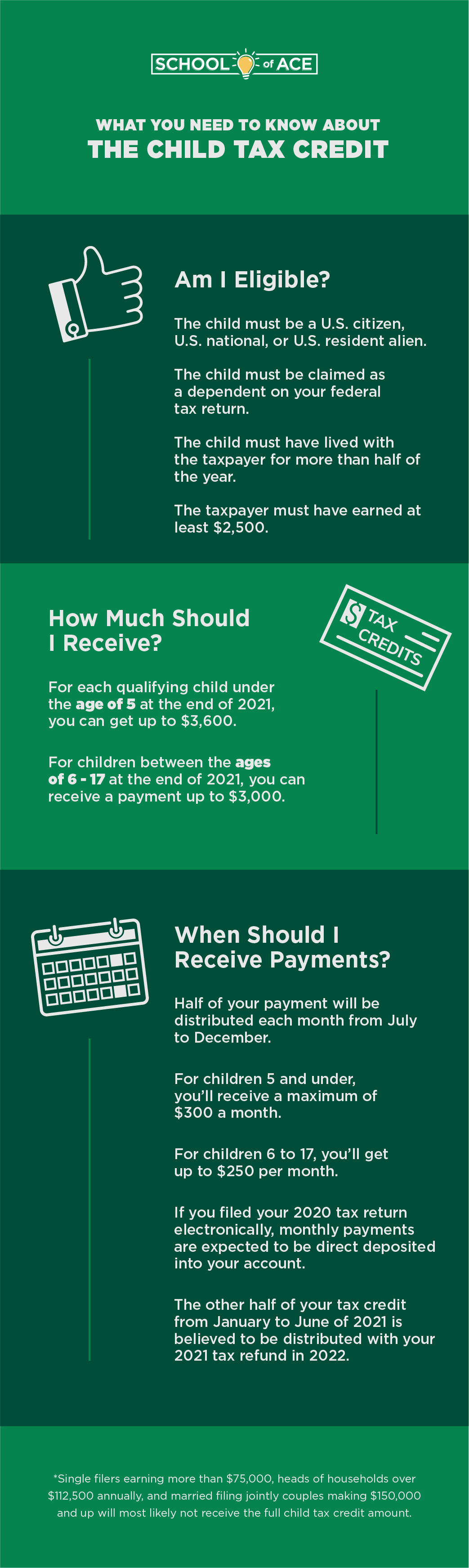

Head Start Eligibility Verification Form. 3600 for each child under age 6 and 3000 for each child ages 6 to 17.

How The New Expanded Federal Child Tax Credit Will Work Colorado Newsline

Last year that maximum value increased to 3600 for children under age 6 and 3000.

. The child tax credit is not new concept. Those who claimed dependents are also eligible to receive a 100 credit per child with a limit of three child credits per household. After this date you can still claim the third stimulus check.

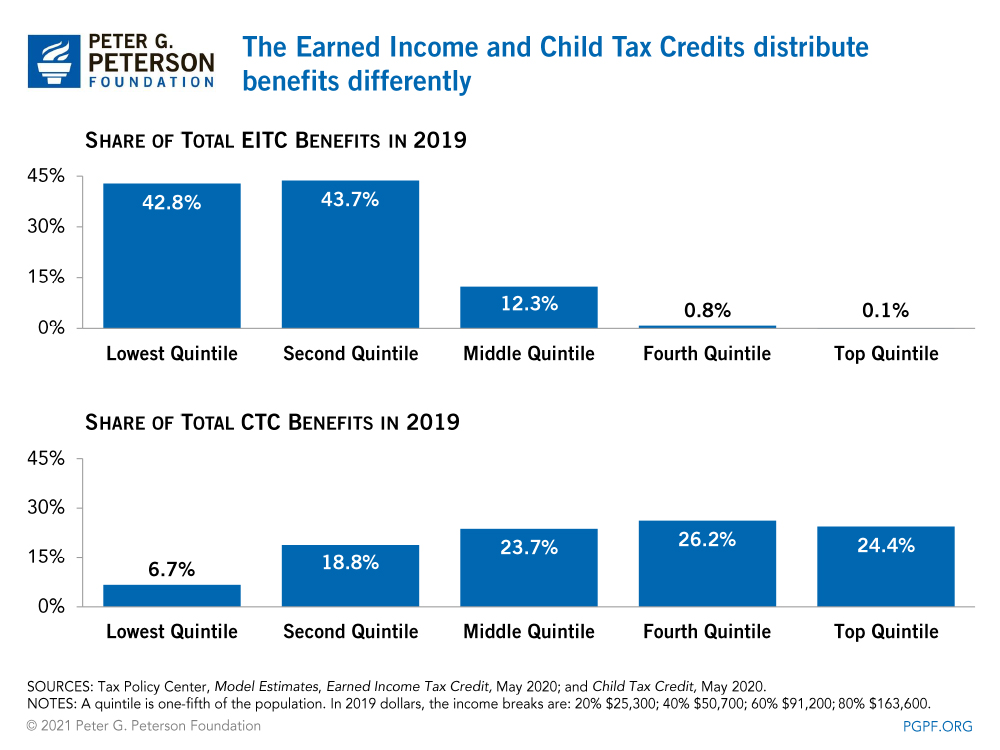

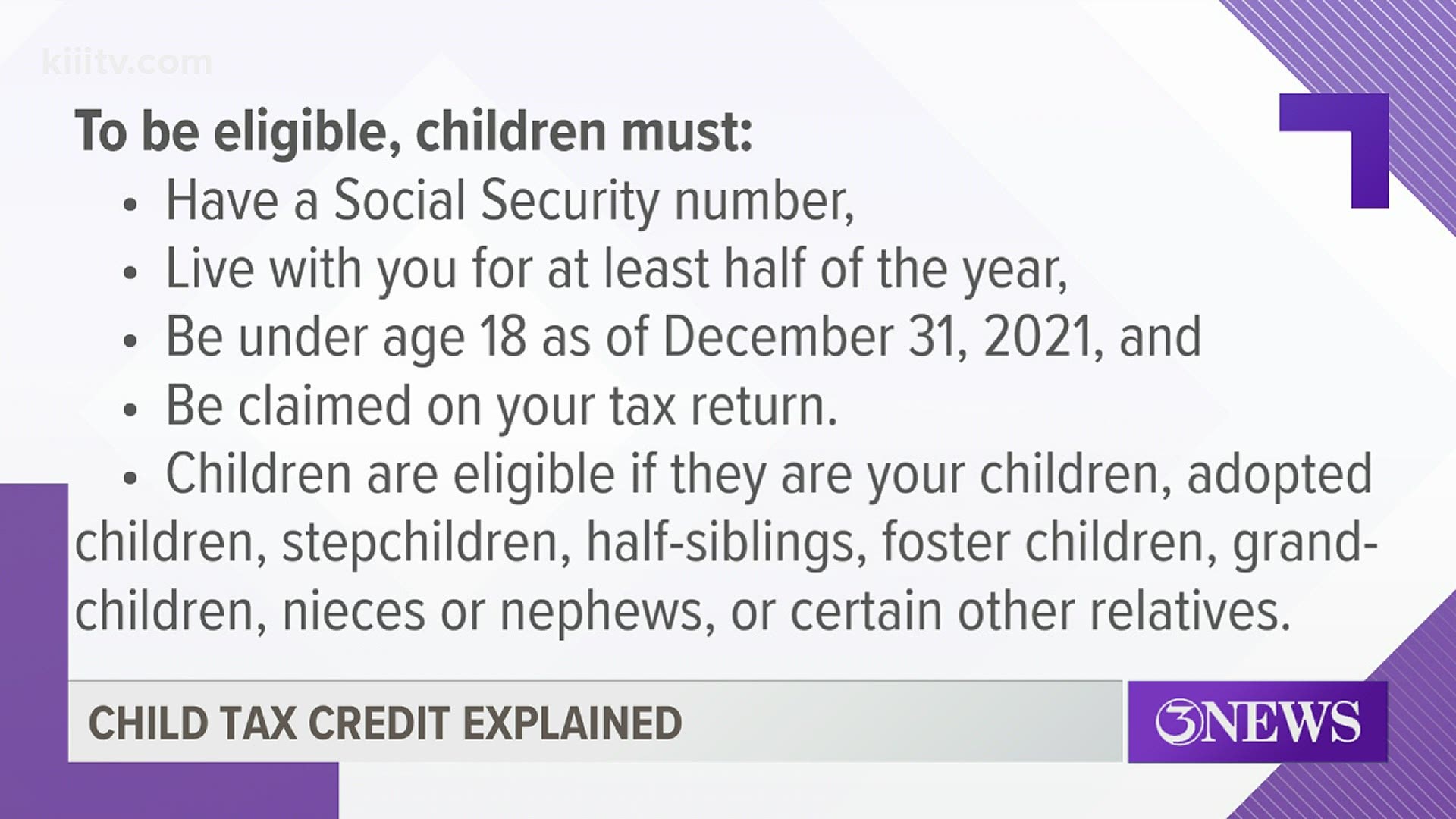

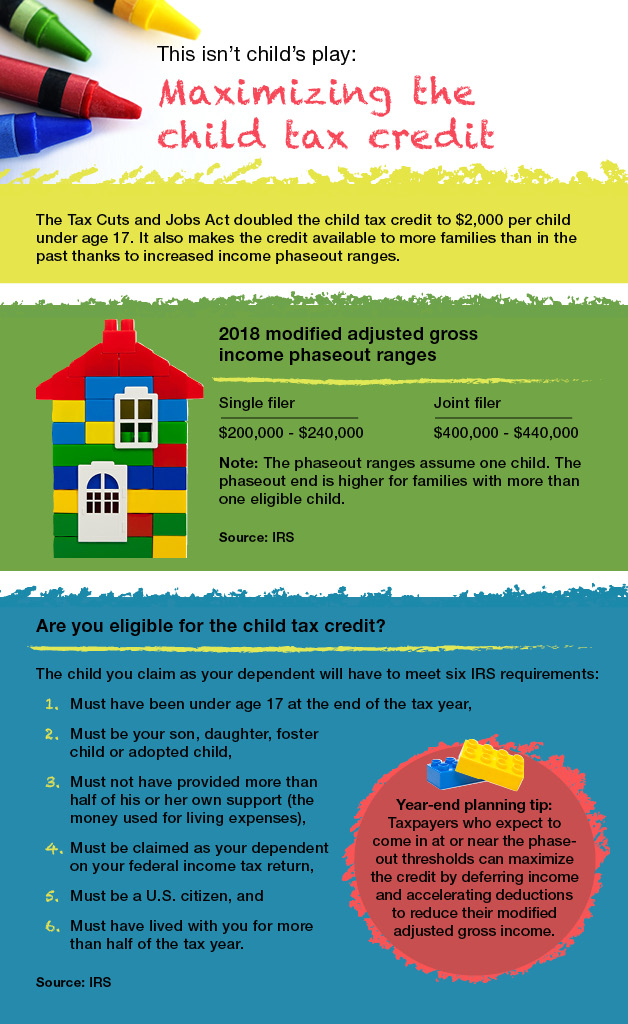

The monthly advance Child Tax Credit payments were as much as 300 for each child under six and 250 for each child six and older. The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. The phase-out threshold was increased from 75000 to 200000.

TDHCA form Single Family Affirmative Marketing Plan for Colonias DOCX HUD 9352B Affirmative Marketing Form Current Version PDF Single Family Affirmative. On October 19 2021 the Texas Workforce Commission TWC approved distribution of 245 billion American Rescue. Most families will receive the full amount.

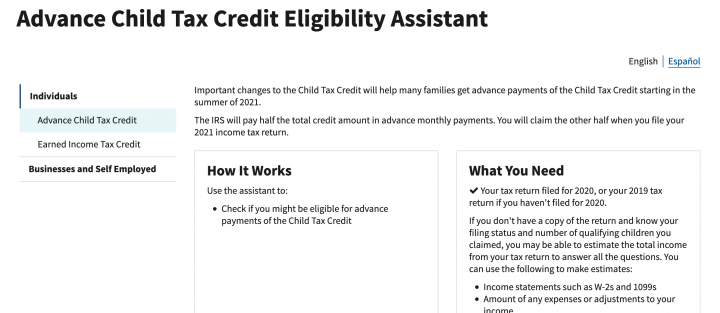

Child credit increased to up to 3600 per child. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. If your child died on or after January 1 2021 you remain eligible to claim the 2021 Child Tax Credit for the full year and no action is required.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. Youll claim the other half of the credit when you file your 2021 taxes due April 18 2022.

Parents must have an earned income of at least 2500. To get money to families sooner the IRS is sending families. The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child.

It does not matter when during the year you. Heres what you need to know. All children must possess a Social Security Number.

That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. This form complies with the eligibility final rule Head Start Program Performance Standard HSPPS 45 CFR 130212 k. The remaining half of the credit for.

In previous years parents filing taxes claimed a 2000. Up to 1800 for each child up to age 5 and up to 1500 for each child age 6-17. Good news Child Care Relief Funding 2022 is here.

Prior to 2021 the maximum value of the Child Tax Credit was 2000 per eligible child.

To Reach Every Child The Child Tax Credit Eligibility Requirements Must Be Changed Center For The Study Of Social Policy

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Child Tax Credit Eligibility Kiiitv Com

Advanced Child Tax Credit Charlotte Center For Legal Advocacy

What You Need To Know About The Child Tax Credit

Fourth Stimulus Check News Summary For Friday 9 July As Usa

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Child Tax Credit For Expats Are You Eligible

Do You Qualify For The Child Tax Credit Payments Find Out Here Wfmynews2 Com

The 2021 Child Tax Credit Information About Payments Eligibility

Ensuring All Eligible Families Receive The Expanded Child Tax Credit The Edredesign Lab

Infographic Maximizing The Child Tax Credit Vonlehman

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

What You Need To Know About The Expanded Child Tax Credit For 2021

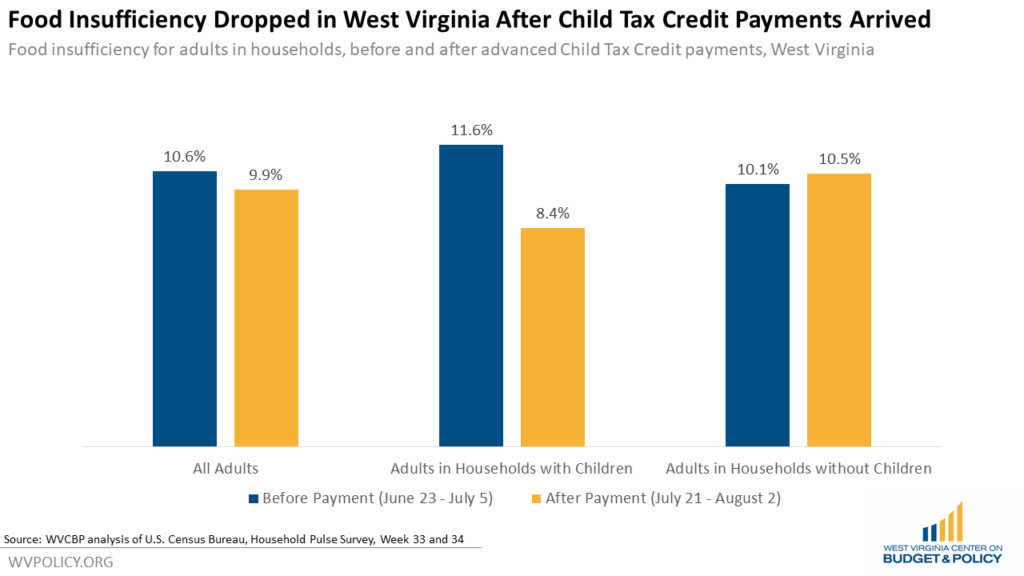

Data Already Showing Positive Impacts Of Child Tax Credit Though More Can Be Done To Ensure Benefit Reaches All Children West Virginia Center On Budget Policy

Information On The Child Tax Credit And Eligibility Newsletter Archive Congressman Jamie Raskin